us germany tax treaty summary

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State. Venezuela 5 515.

German Tax Advice For Smart Foreign Real Estate Investors Owners

2 What Is The U S Germany Income Tax Treaty Becker International Law 2.

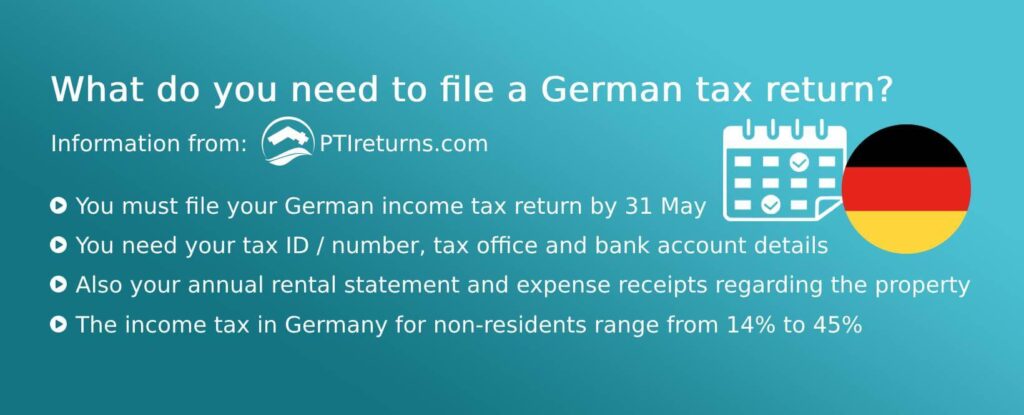

. 4 Income From Real Property. Box 1 income is subject to progressive rates of 3665 up to 5175 with a 14 base deduction for entrepreneurs. If A is tax resident in Germany 76 of his pension will be taxed.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. The purpose of the USFrance Tax Treaty is to help Taxpayers determine. Us germany tax treaty summary Thursday June 9 2022 Edit.

Definition of USCanada Tax Treaty. Germany - Tax Treaty Documents. Article 11 of the United States- Germany Income Tax Treaty deals with the taxation interest.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Under the treaty if a German decedent bequeaths the US. Corporate Tax Manager PwC Germany 49 201 438 1975.

This percentage increases up to 2020 by 2 per year and from then on by 1. Alongside income tax there is also a solidarity tax of a maximum of 55 of the income tax you owe. It is important that you read both the treaty and the protocols that would apply to the tax year in which the payment is made.

In the year 2040 the percentage will be 100. 2 Saving Clause and Exceptions. A protocol is an amendment to a treaty.

About Our International Tax Law Firm. France and the United States have been engaged in treaty relations for more than 50-years and first entered into a modern-day tax treaty nearly 55-years ago 1967. The treaty has been updated and revised multiple times since then with the most recent version being 2009.

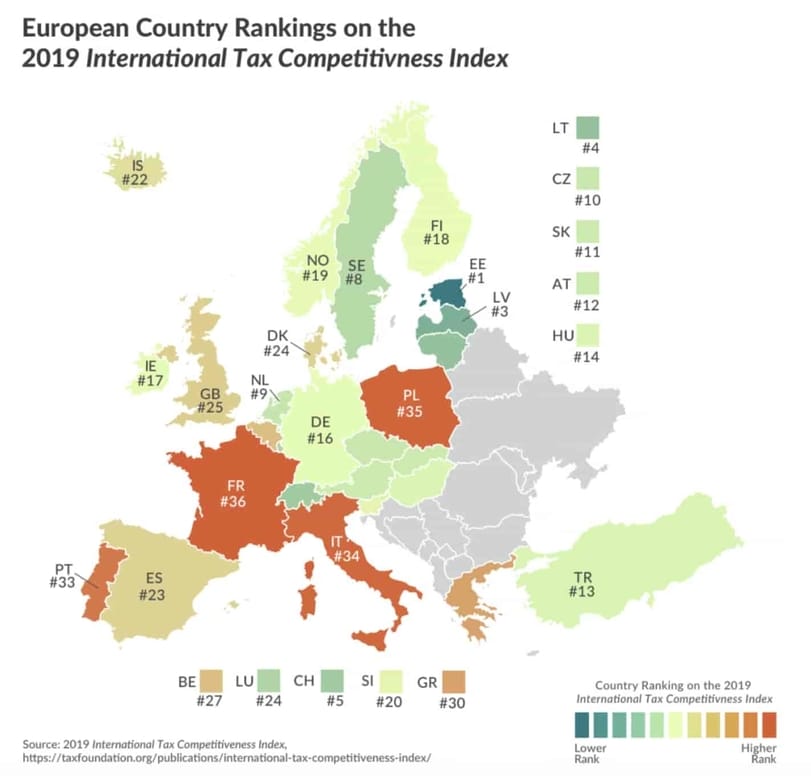

Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital. Box 2 income is taxed at a rate of 25.

You can obtain the full text of these treaties at United States Income Tax Treaties - A to Z. 30 for Germany and Switzerland for contingent interest that does not qualify as portfolio interest. The purpose of the USGermany Tax Treaty is to help Taxpayers determine what their tax liability is for certain sources of taxable income involving parties to the treaty.

Estate and Gift Tax Treaty. The complete texts of the following tax treaty documents are available in Adobe PDF format. German income tax rates range from 0 to 45.

Uzbekistan 5 7 515. Certain exceptions modify the tax rates. German residents have significant advantages over residents of other countries due to the favorable provisions contained in the estate tax treaty between the US.

25 0 15 or upon application as reduced by EU directivedouble tax treatydomestic law. The rate is 15 10 for Bulgaria. Initially formed in the year of 1980 this mutual taxation agreement limits the duties between Canadian and US citizens and permanent residents that live in on the other side of the border.

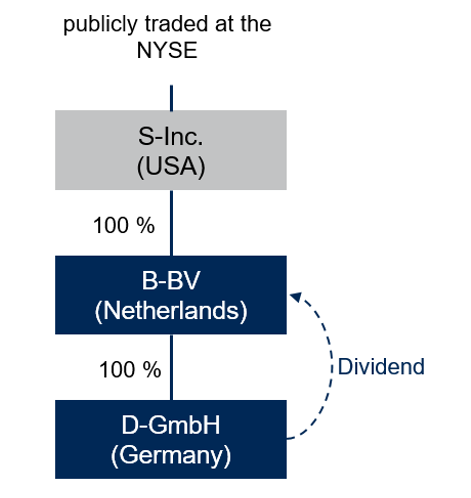

German income tax rates are relatively high compared to the US so for many people it will make sense to claim the Foreign Tax Credit. The protocol signed at berlin on june 1 2006 amended article 26 of the tax treaty between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes. Where the EC ParentSubsidiary Directive applies dividends paid by a German company to a qualifying parent company resident in another EU member state are exempted from German WHT.

A New Certainty Under The Germany-US Tax Treaty Götz Wiese Stefan Süss Latham Watkins LLP Latham Watkins LLP Law360 New York July 31 2014 1015 AM ET -- In a recent judgment file no. 7 of the new tax treaty between Germany and the US. We strongly recommend that if you have any doubts or.

In other words a Canadian citizen who is living in the US for a work placement wont need to face double taxation. Both forms of tax are reduced by treaty relief. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

9 Golding Golding. Germany and the United States have been engaged in treaty relations for many years. The treaty has been updated and revised with the most recent version being 2006.

United States 5 10 0515. The tax treaty provides that corporate dividends are taxable in the country where the. Box 3 a fixed presumed gain of the market value of the Box 3 assets minus debt is taxed at a flat rate of 30.

Property to his or her German surviving spouse 50 of the value of the property is excluded from US. For example if a German company establishes a branch office in Florida the profits attributed to that branch are taxable in the United States because the German company has created a permanent establishment in the United States. United States and Germany Sign New Protocol to Income Tax Treaty SUMMARY On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. 8 Exchange of Information. 61 rows Summary of US tax treaty benefits.

The fixed presumed gain in Box 3 is based on the average. Us germany tax treaty summary. 1 US-Germany Tax Treaty Explained.

Technical Explanation of the Convention. 3 Relief From Double Taxation. The rate is 15 for interest.

I R 4812 the German Federal Fiscal Court has commented on Art. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts as amended by the Protocol to the German American Treaty generally referred to as the Germany-US. This table also shows the general effective date of each treaty and protocol.

United States Uruguay Uzbekistan Republic of. Most importantly for German investors in the United States the Protocol. United States Germany Income Tax Treaty Sf Tax Counsel Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax.

24 will be tax-free. A receives in the year 2018 his US social security pension for the first time.

Us Military In Germany To Create List Of People Targeted By Local Tax Authorities In Spite Of Sofa Status Stars And Stripes

German Withholding Tax Arising From Intellectual Properties Transactions New German Guidance On Ip Nexus Pwc Tls Blog

Double Taxation Taxes On Income And Capital Federal Foreign Office

Germany S Coalition Agreement Deloitte Legal Germany

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

What Is The U S Germany Income Tax Treaty Becker International Law

German Tax Advice For Smart Foreign Real Estate Investors Owners

Germany Tax Information Income Taxes In Germany Tax Foundation

The Dawes Plan 1924 The Young Plan 1929 How To Plan German Propaganda Lent

After Brexit German Uk Tax Aspects Rsm

United States Germany Income Tax Treaty Sf Tax Counsel

Taxes In Germany A Competitive Tax System Universal Hires

Germany Usa Double Taxation Treaty

Crypto Tax Guide Germany 2022 Kryptowahrung Steuer 2022 Koinly

German Law Removes Us S Corporation Tax Benefit

The Shortest History Of Germany Review Probing An Enigma At The Heart Of Europe History Books The Guardian